In the evolving landscape of cryptocurrency, one of the most fascinating developments is the concept of Atomic Swaps. These are revolutionary techniques allowing for the exchange of different cryptocurrencies without the need for traditional intermediaries like exchanges. Understanding Atomic Swaps requires a dive into how they work, their implications, and the differences in their application across various cryptocurrencies.

What are Atomic Swaps?

At its core, an Atomic Swap is a technology enabling the direct peer-to-peer exchange of cryptocurrencies across different blockchain networks. This process is secured through a combination of cryptographic techniques, negating the need for a trusted third party. The term “atomic” in this context is derived from computer science, meaning that the swap either happens entirely or not at all, ensuring that neither party in the exchange is left at a disadvantage.

The Mechanism Behind Atomic Swaps

The fundamental technology enabling Atomic Swaps is the Hashed Time-Locked Contracts (HTLCs). These are a type of smart contract that require the receiver of a transaction to acknowledge receiving the payment within a certain timeframe by generating cryptographic proof. If the receiver fails to confirm the transaction in time, the funds are returned to the sender. This mechanism is pivotal in ensuring trustless exchanges.

Example of an Atomic Swap

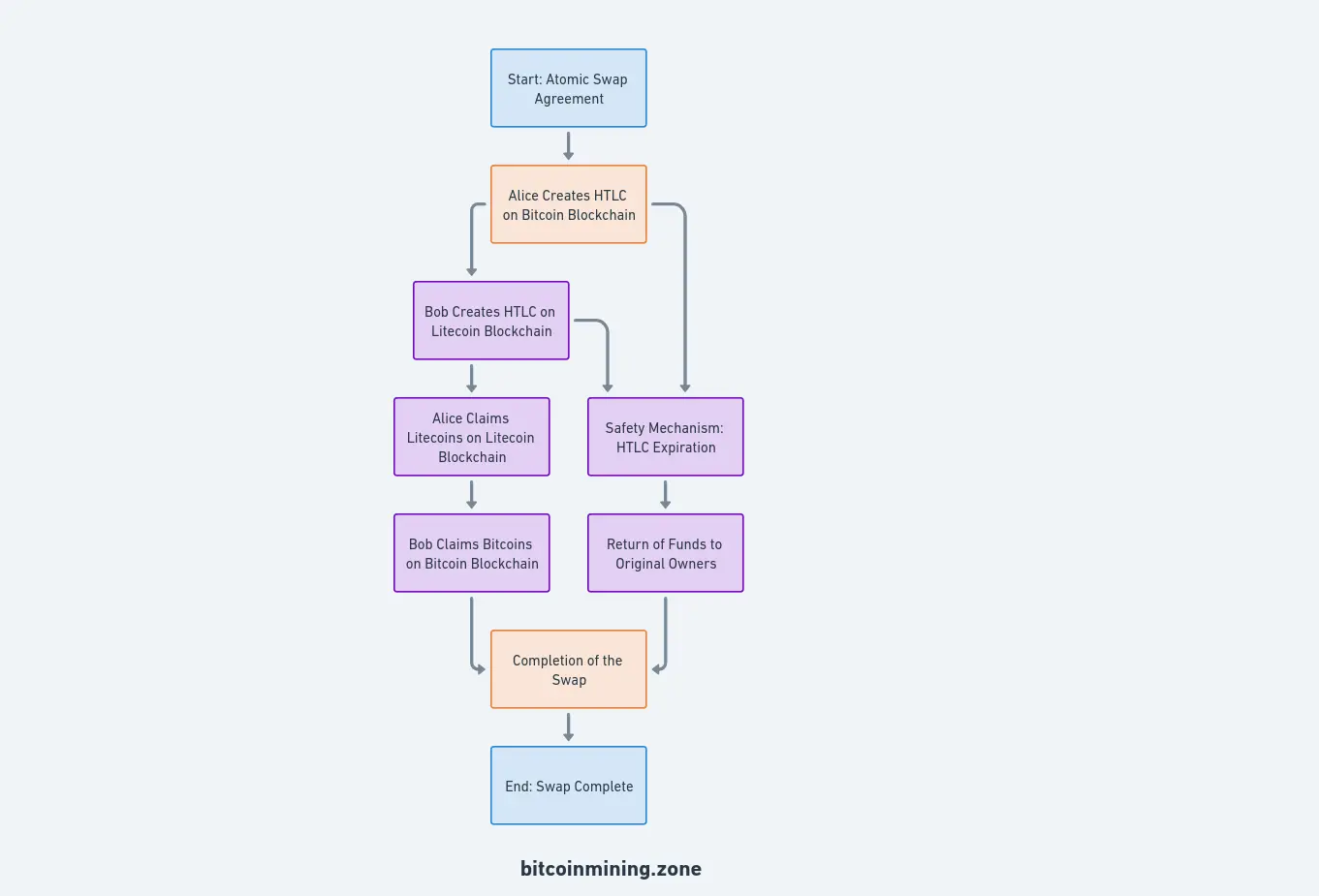

- Initial Agreement: Alice and Bob agree on an Atomic Swap, where Alice will exchange her Bitcoins for Bob’s Litecoins.

- Alice Creates an HTLC on Bitcoin Blockchain: Alice starts the process by creating a Hashed Time-Locked Contract (HTLC) on the Bitcoin blockchain. She deposits her Bitcoins into this contract. The HTLC is secured with a cryptographic hash function, and Alice generates a secret key for this, but keeps it hidden for now.

- Bob Responds on Litecoin Blockchain: Observing Alice’s commitment, Bob then creates a corresponding HTLC on the Litecoin blockchain. He deposits his Litecoins into it, using the same cryptographic hash as Alice’s contract to ensure that both contracts are interdependent.

- Alice Claims Litecoins: Alice, seeing Bob’s Litecoin deposit, proceeds to claim these Litecoins. She unlocks Bob’s HTLC on the Litecoin blockchain using her secret key. In doing so, she reveals this key publicly on the Litecoin blockchain.

- Bob Claims Bitcoins: With the secret key now revealed, Bob accesses Alice’s HTLC on the Bitcoin blockchain. He uses the now-public secret key to unlock the contract and claim the Bitcoins that Alice deposited.

- Completion of the Swap: The Atomic Swap is now complete. Alice has successfully exchanged her Bitcoins for Bob’s Litecoins, and vice versa, all without involving any intermediaries.

- Safety Mechanism: It’s important to note that if either Alice or Bob had failed to act within the time limits set by the HTLCs, the contracts would expire. This expiration would return the deposited cryptocurrencies to their original owners, ensuring that neither party risks losing their funds if the swap doesn’t complete.

Through this process, Alice and Bob demonstrate the efficiency and security of Atomic Swaps, showcasing their ability to facilitate direct cryptocurrency exchanges across different blockchain networks.

Through this process, Alice and Bob demonstrate the efficiency and security of Atomic Swaps, showcasing their ability to facilitate direct cryptocurrency exchanges across different blockchain networks.

Atomic Swaps with Smart Contract Capable Cryptocurrencies

Cryptocurrencies like Ethereum, which support complex smart contracts, can facilitate more advanced forms of Atomic Swaps. These smart contracts can automatically execute the terms of the swap when conditions are met, providing a seamless and secure transaction process. Developers can write these contracts in languages such as Solidity, and they can include detailed rules and conditions governing the swap.

Atomic Swaps in Cryptocurrencies Without Native Smart Contract Support

Bitcoin and Litecoin do not natively support complex smart contracts. However, they can still participate in Atomic Swaps thanks to their scripting capabilities. For instance, Bitcoin’s scripting language allows for creating HTLCs, which are essential for Atomic Swaps. While these contracts are simpler compared to those on platforms like Ethereum, they are still effective for trustless exchanges.

Challenges and Limitations

Conclusion

Atomic Swaps represent a significant stride towards a more decentralized and efficient cryptocurrency ecosystem. They offer a glimpse into a future where cross-chain exchanges can be conducted securely, cheaply, and without reliance on central authorities. As blockchain technology continues to mature, we can expect Atomic Swaps to become more streamlined and widely adopted, further enhancing the interoperability and utility of cryptocurrencies.

FAQ:

1. What is an Atomic Swap in cryptocurrency?

An Atomic Swap is a technology that enables the exchange of one cryptocurrency for another across different blockchain networks without the need for a trusted intermediary, using smart contracts and cryptographic techniques.

2. How do Atomic Swaps enhance security in cryptocurrency transactions?

Atomic Swaps enhance security by using Hashed Time-Locked Contracts (HTLCs) that ensure a transaction is completed only when both parties fulfill their obligations, thus eliminating the risk of fraud.

3. Can you perform an Atomic Swap between Bitcoin and Ethereum?

Yes, it’s possible to perform an Atomic Swap between Bitcoin and Ethereum, provided there’s compatibility in their cryptographic hash functions and implementation of HTLCs.

4. What technical skills are required to create a smart contract for an Atomic Swap?

Creating a smart contract for an Atomic Swap requires knowledge of blockchain technology and proficiency in a blockchain-specific programming language, such as Solidity for Ethereum.

5. Are Atomic Swaps possible on all cryptocurrencies?

No, Atomic Swaps are not possible on all cryptocurrencies. They require blockchains that support compatible cryptographic hash functions and scripting for HTLCs.

6. What are Hashed Time-Locked Contracts (HTLCs)?

HTLCs are a type of smart contract used in Atomic Swaps that lock funds until the recipient submits cryptographic proof of payment within a specified timeframe.

7. Do Atomic Swaps require a special wallet?

While a special wallet isn’t necessary, users need a cryptocurrency wallet that supports the specific blockchain and is capable of interacting with HTLCs for Atomic Swaps.

8. What are the main challenges in implementing Atomic Swaps?

The main challenges include the need for compatible cryptographic hash functions across blockchains, finding matching trade parties, technical complexity, and ensuring cross-chain communication.

9. How do Atomic Swaps differ from traditional cryptocurrency exchanges?

Unlike traditional exchanges that act as intermediaries, Atomic Swaps allow for direct peer-to-peer exchanges across different blockchains without needing a central authority.

10. Can Atomic Swaps be reversed?

No, once completed, Atomic Swaps cannot be reversed. However, if the conditions of the HTLC are not met within the specified time, the funds are returned to the sender.

11. How does liquidity affect Atomic Swaps?

Liquidity can be a challenge for Atomic Swaps since they depend on finding a matching party willing to trade the exact amounts of respective cryptocurrencies, which might not always be readily available.

12. Are there fees involved in conducting an Atomic Swap?

Yes, there are typically network transaction fees involved in conducting an Atomic Swap, which vary depending on the blockchains used.

13. Is it possible to automate Atomic Swaps?

Yes, Atomic Swaps can be automated using smart contracts, which execute the terms of the swap when predetermined conditions are met.

14. How does the Atomic Swap process work with cryptocurrencies that don’t support smart contracts?

For cryptocurrencies that don’t support complex smart contracts, simpler scripting capabilities like those in Bitcoin and Litecoin can be used to create HTLCs, enabling Atomic Swaps.

15. What future developments are expected to enhance Atomic Swaps?

Future developments may include improved blockchain interoperability, more user-friendly tools for conducting swaps, and increased standardization across blockchains to overcome current limitations.