In the ever-evolving world of cryptocurrency trading, understanding market dynamics is key to making informed decisions. Among the myriad strategies and phenomena that traders encounter, the concept of ‘sell the news’ stands out for its intriguing blend of psychology, market sentiment, and economic principles. Predominantly observed in the Bitcoin market, this phenomenon encapsulates how traders respond to anticipated news events, often leading to unexpected market movements. This article delves into the intricacies of ‘sell the news’, exploring its definition, the process of news creation in financial markets, strategies to recognize such events, and a detailed chronological timeline of how these events unfold. Whether you’re a seasoned trader or new to the Bitcoin arena, this guide aims to demystify ‘sell the news’, providing insights to navigate the complexities of cryptocurrency trading with greater understanding and acumen.

Definition of “Sell the News” in Bitcoin Context

In the realm of Bitcoin trading, the phrase “sell the news” represents a pivotal strategy that has both intrigued and perplexed investors. This phenomenon is grounded in the behavior of market participants who respond to anticipated news events, shaping their investment decisions based on expectations rather than the substantive outcome of the news itself.

At its core, “sell the news” involves a pre-emptive response to news events that are expected to impact the price of Bitcoin. Traders often speculate on the potential effects of upcoming news, such as regulatory changes, technological advancements, or significant partnerships. This speculation leads to action before the actual news breaks – investors buy or hold Bitcoin as the event approaches, driving up its price based on their expectations.

The crux of the strategy, however, lies in the aftermath of the news release. Regardless of whether the news is positive or negative, a common reaction is seen where traders quickly sell off their Bitcoin. This is a strategic move to capitalize on the elevated prices resulting from the pre-news hype. The rationale is straightforward: prices are perceived to have peaked with the anticipation, and the actual news might not provide sufficient momentum to push them higher, leading to a potential decline.

It’s important to note that “sell the news” is less about the content of the news and more about market psychology and dynamics. The strategy hinges on the anticipation build-up and the collective expectation of the market, making it a unique aspect of trading in the volatile world of Bitcoin. This phenomenon underscores the complex interplay between market sentiment, news cycles, and asset valuation, offering a fascinating glimpse into the behavioral patterns of cryptocurrency traders.

Creation of News in Financial Markets

The landscape of financial news, especially in the context of Bitcoin and cryptocurrencies, is a complex ecosystem comprising various sources and channels. Understanding these sources is essential for any investor or trader, as they significantly influence market movements and strategies like “sell the news.” Here’s an overview of the primary sources of financial news:

- Official Announcements: These are authoritative sources of news and include press releases from companies, policy statements from governments and regulatory bodies, and official statements from central banks or financial institutions. In the context of Bitcoin, this could include announcements about new regulations, legal developments, or official endorsements.

- Media Outlets: Traditional media outlets like financial newspapers, magazines, TV channels, and online financial news websites play a crucial role in disseminating news. They often provide analysis, expert opinions, and cover a wide range of topics including market trends, economic indicators, and corporate news. However, the interpretation and presentation of news can vary, introducing elements of bias or sensationalism.

- Market Analysts and Experts: Financial analysts, economists, and industry experts often provide insights and forecasts that can influence market sentiment. Their analyses, reports, and commentaries, whether through media channels or personal platforms, can sway investor behavior and market trends.

- Social Media and Online Forums: Platforms like Twitter, Reddit, and various cryptocurrency forums have become significant sources of news and rumors. Information on these platforms can spread rapidly, but it’s often unverified and highly speculative. The decentralized and informal nature of social media makes it a double-edged sword: it can offer early insights but also propagate misinformation.

- Rumors and Leaks: Unofficial sources, such as rumors, leaks, or insider information, can also impact the markets. While these can sometimes provide early hints about significant developments, they are inherently unreliable and should be treated with caution.

It’s important to note that while financial news is a crucial element of market dynamics, it is not inherently propaganda. However, the sources of news can be subject to biases, varying levels of credibility, and sometimes even intentional misinformation. Therefore, it’s vital for participants in the financial markets, especially in the volatile realm of Bitcoin, to critically assess news sources, cross-verify information, and maintain a balanced view to make informed decisions.

Recognizing “Sell the News” Events in Bitcoin

Identifying a “sell the news” event within the Bitcoin market requires a nuanced understanding of various market indicators and the ability to interpret the interplay of news, sentiment, and market behavior. Here are some key strategies that traders and investors can employ to recognize these events:

- Following Market News: Staying abreast of the latest developments in the cryptocurrency world is crucial. This includes keeping track of upcoming events that could potentially impact Bitcoin’s price, such as regulatory announcements, key technological updates, or major adoption news by influential companies or governments.

- Monitoring Market Sentiment: Understanding the mood of the market can offer invaluable insights. This involves analyzing the general attitude of investors and traders towards Bitcoin, which can be gauged through social media trends, investor forums, and sentiment analysis tools. A surge in positive sentiment or hype, especially ahead of a major news event, might be a precursor to a “sell the news” scenario.

- Utilizing Technical Analysis: Technical indicators are vital tools in a trader’s arsenal. By examining Bitcoin’s price charts, one can look for signs of overbuying or speculative bubbles. Indicators like the Relative Strength Index (RSI), Moving Averages, or Bollinger Bands can signal whether Bitcoin is being traded heavily in anticipation of an event.

- Volume Analysis: Paying attention to trading volumes can provide clues about the strength of a price move. An increase in volume might indicate a growing interest leading up to a news event, whereas a sudden spike in volume after the news release, especially if accompanied by a price decline, might suggest a “sell the news” reaction.

- Comparing Expectations vs. Reality: It’s crucial to assess how the actual news measures up to market expectations. In many cases, the news might already be priced in. If the actual news is in line with or less impactful than expected, it might trigger a selling response, as the anticipatory buildup does not lead to further price surges.

- Considering Historical Patterns: Reviewing how Bitcoin reacted to similar news in the past can provide valuable context. Historical patterns, while not always repeatable, can offer insights into how the market might respond to similar stimuli.

By integrating these strategies, investors and traders can enhance their ability to discern potential “sell the news” events in the Bitcoin market. However, it’s important to remember that the cryptocurrency market is inherently volatile and unpredictable. As such, these strategies should be part of a broader, well-rounded approach to market analysis and investment decision-making.

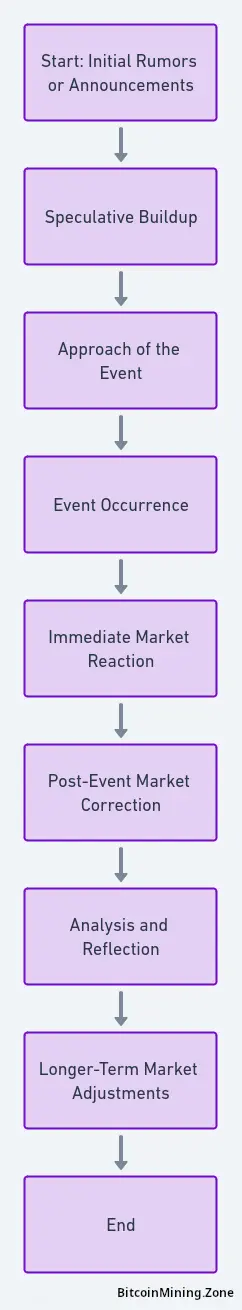

Chronological Timeline of a “Sell the News” Event

A “sell the news” event in the Bitcoin market typically unfolds in several distinct stages. Understanding this timeline can provide traders and investors with valuable insights into market dynamics and help them make more informed decisions.

- Initial Rumors or Announcements: The cycle often begins with rumors or announcements about an upcoming event that could impact Bitcoin’s value. This could be anything from regulatory changes, technological updates, to major corporate adoptions. Investors start to pay close attention, leading to speculative discussions and predictions.

- Speculative Buildup: In this phase, anticipation and speculation intensify. Investors and traders buy Bitcoin, predicting that the news will positively impact its price. The market sees increased activity, and Bitcoin’s price may begin to rise, often fueled by media coverage and discussions on social media and trading forums.

- Approach of the Event: As the event draws closer, the market often experiences heightened volatility. Traders and investors may increase their positions in Bitcoin, leading to further price increases. This period is characterized by a mix of optimism and anxiety, as market participants speculate on the potential impact of the upcoming news.

- Event Occurrence: The anticipated event finally takes place. This could be a regulatory announcement, a major technological breakthrough, a key partnership, or any other significant development affecting Bitcoin. The actual content of the news is now available for market participants to evaluate.

- Immediate Market Reaction: Immediately following the news, Bitcoin’s price reacts. Contrary to expectations, the reaction might be a sell-off, even if the news is positive. This sell-off is the core of the “sell the news” phenomenon, where traders and investors capitalize on the price increase leading up to the event by selling their holdings.

- Post-Event Market Correction: Following the initial sell-off, the market begins to correct itself. The price of Bitcoin stabilizes as it adjusts to the new information and market sentiment. This phase can vary in duration and intensity, depending on the nature of the news and broader market conditions.

- Analysis and Reflection: After the event and the subsequent market reaction, analysts and investors reflect on the outcomes. This involves dissecting how the event’s anticipation affected the market and how the actual news aligned with or diverged from expectations. Lessons learned during this phase can be invaluable for future trading strategies and understanding market psychology.

- Longer-Term Market Adjustments: Depending on the significance of the news, there may be longer-term effects on Bitcoin’s market dynamics and investor sentiment. These adjustments reflect the market’s ongoing assimilation of the news and its implications for the future of Bitcoin.

Each “sell the news” event is unique, and not all events follow this timeline precisely. However, understanding this general pattern can help market participants anticipate and respond to similar scenarios in the future. It’s a crucial aspect of navigating the often unpredictable and volatile landscape of Bitcoin trading.

Risks and Considerations in Market Speculation

Engaging in market speculation, especially in a volatile market like Bitcoin, entails navigating a terrain filled with both opportunities and pitfalls. A key aspect of this speculative endeavor involves predicting market movements based on news events, a task fraught with inherent risks and uncertainties.

The speculative nature of market movements means that even well-founded predictions can be upended by unforeseen variables. News events, particularly in the cryptocurrency space, can trigger unpredictable market reactions. What might seem like positive news could lead to a sell-off, and vice versa, defying conventional expectations. This unpredictability underscores the inherent risk in basing trading decisions solely on news anticipation.

Moreover, the impact of news on the market can be swift and dramatic, leaving little time for reaction. Market sentiment can shift rapidly, often driven by a herd mentality, leading to overreactions or panic selling. These market dynamics can be challenging even for seasoned traders and particularly perilous for novices.

In light of these challenges, thorough research and due diligence become paramount. This involves not just staying updated with the latest news and developments but also understanding the deeper market trends, historical data, and the technical aspects of trading. It’s essential to look beyond the surface of news events and analyze how similar situations have unfolded in the past and what different outcomes might imply for future trends.

Personal risk assessment is another critical component of responsible trading. This means acknowledging one’s risk tolerance, investment goals, and the financial capacity to absorb potential losses. Diversifying investments, setting stop-loss orders, and not investing more than one can afford to lose are prudent practices in this regard.

In conclusion, while predicting market movements based on news events is an integral part of market speculation, it should be approached with caution and a well-informed strategy. Balancing speculative decisions with thorough research and a clear understanding of personal risk tolerance is essential for navigating the unpredictable waters of Bitcoin trading.

Conclusion:

The world of Bitcoin trading, with its unique dynamics and the intriguing ‘sell the news’ phenomenon, presents a fascinating yet challenging landscape for traders and investors. As we’ve explored, understanding this phenomenon requires more than just a keen eye on market news; it demands a comprehensive approach that combines technical analysis, sentiment monitoring, and a deep dive into market psychology.

However, the volatile and speculative nature of Bitcoin markets cannot be overstated. While strategies like ‘sell the news’ offer insights into market trends, they also highlight the unpredictable and often irrational nature of market behavior. This unpredictability serves as a reminder of the risks inherent in cryptocurrency trading and the importance of approaching it with diligence, research, and a well-calibrated sense of risk tolerance.

For those navigating these digital currency waters, the key lies in balancing informed speculation with cautious investment practices. By staying updated on market news, understanding the broader economic landscape, and critically evaluating both the source and content of news, traders can better position themselves in this dynamic market. Moreover, personal risk assessment, diversification, and a long-term perspective are crucial in mitigating risks and capitalizing on opportunities in the Bitcoin market.

In conclusion, while the allure of quick profits in response to market news can be strong, success in Bitcoin trading is often a result of patience, continuous learning, and a disciplined approach to risk management. As the cryptocurrency market continues to evolve, staying informed and adaptable will remain essential for anyone looking to succeed in this exciting and challenging arena.

FAQ:

1. What triggers a ‘sell the news’ event in Bitcoin markets?

Typically, a ‘sell the news’ event is triggered by the culmination of a highly anticipated event, such as a regulatory announcement or a major corporate investment in Bitcoin, where the actual event leads to a swift sell-off.

2. How does social media influence ‘sell the news’ events?

Social media can amplify market expectations and speculation, often leading to inflated pre-event hype which contributes to a sharper ‘sell the news’ reaction when the event occurs.

3. Can ‘sell the news’ events be predicted with accuracy?

While certain indicators can suggest a potential ‘sell the news’ event, predicting them with complete accuracy is challenging due to market unpredictability and external factors.

4. Is ‘sell the news’ a strategy exclusive to Bitcoin?

No, ‘sell the news’ is a common phenomenon in various financial markets, but it is particularly notable in volatile markets like Bitcoin.

5. What role do market analysts play in ‘sell the news’ events?

Market analysts can influence trader expectations through their forecasts and opinions, which might contribute to the buildup leading to a ‘sell the news’ event.

6. How important is technical analysis in identifying ‘sell the news’ events?

Technical analysis is crucial as it helps identify overbought conditions and speculative bubbles that often precede a ‘sell the news’ event.

7. Are there any tools to monitor market sentiment for ‘sell the news’ events?

Yes, there are various tools and platforms that analyze social media, news trends, and investor forums to gauge market sentiment.

8. How does one differentiate between ‘sell the news’ and normal market corrections?

‘Sell the news’ events are typically characterized by a rapid sell-off following a specific news event, unlike normal market corrections which may not be tied to a single news item.

9. Can long-term investors benefit from ‘sell the news’ events?

Long-term investors might find opportunities in ‘sell the news’ events by purchasing assets at lower prices post-event, provided it aligns with their investment strategy.

10. What is the risk of misinterpreting a ‘sell the news’ event?

Misinterpreting such an event can lead to untimely trades, resulting in potential losses or missed opportunities.

11. How does market volume change during a ‘sell the news’ event?

Market volume typically increases as the event approaches and can spike during the sell-off phase of the event.

12. Can regulatory announcements always trigger ‘sell the news’ events?

Not always, but regulatory announcements are significant influencers in the crypto market and can trigger such events depending on investor expectations.

13. How does investor psychology play into ‘sell the news’ events?

Investor psychology is a key factor, as decisions are often driven by the anticipation of an event rather than the event’s actual outcome, leading to emotional trading decisions.

14. What is the best way to respond to a ‘sell the news’ event?</strong

The best response varies based on individual investment strategy, but generally involves careful analysis of the event’s impact, assessing market conditions, and aligning actions with long-term investment goals.

15. Can ‘sell the news’ events offer short-term trading opportunities?

Yes, for experienced traders who can navigate the volatility, ‘sell the news’ events can offer opportunities for short-term gains through strategic buying and selling.