A Deep Dive into the Data: Unraveling Bitcoin’s Digital Fabric

In the ever-evolving landscape of Bitcoin, the interplay of various factors shapes its economic ecosystem. A recent analysis, utilizing a comprehensive dataset spanning several months in late 2023, provides new insights into this dynamic digital economy. The dataset, comprising over 5,500 data points, covers essential metrics like block count, hashrate, Bitcoin price, market capitalization, and transaction volumes.

Data Matrix: A Composite View of Bitcoin’s Landscape

The cornerstone of this analysis is a carefully curated data matrix, combining information from a Bitcoin Core node with additional market data. Spanning from November 2023, this dataset encompasses over 5,500 individual entries, each entry a snapshot of Bitcoin’s multifaceted market dynamics.

While the Bitcoin Core node provided foundational blockchain metrics such as block count and transaction volumes, crucial market indicators like the hashrate and the Bitcoin price in USD were sourced from external market data. This integration of internal blockchain metrics with external market indicators offers a comprehensive view, blending the technical operations of the Bitcoin network with its market performance.

Focus on Hashrate and Bitcoin Price

Central to this analysis were two specific metrics: the hashrate and the Bitcoin price in USD. The hashrate, sourced from market data, serves as a proxy for the collective computational power dedicated to mining and transaction processing on the Bitcoin network. It’s a key indicator of mining activity, network health, and overall competition among miners.

The Bitcoin price, also derived from external market data, is a direct measure of the cryptocurrency’s market value. Fluctuations in Bitcoin price reflect the complex interplay of investor sentiment, global economic conditions, and a myriad of other market forces.

By analyzing these two metrics side by side, the study aimed to unravel the relationship between the technical prowess of the Bitcoin network and its perceived value in the eyes of investors and the broader market.

Hashrate: The Pulse of Bitcoin Mining

The hashrate, a measure of the total computational power used in mining and transaction processing on Bitcoin’s blockchain, stands as a testament to the network’s health and security. A higher hashrate not only points to increased mining activity but also signifies a more robust and secure network, essential for maintaining blockchain integrity.

Bitcoin Price: The Market’s Verdict

Alongside the hashrate, the Bitcoin price offers a direct glimpse into market sentiments and the perceived value of Bitcoin. Fluctuating based on diverse factors like investor behavior, global economic conditions, and regulatory developments, the price of Bitcoin serves as a barometer for the cryptocurrency’s acceptance and viability.

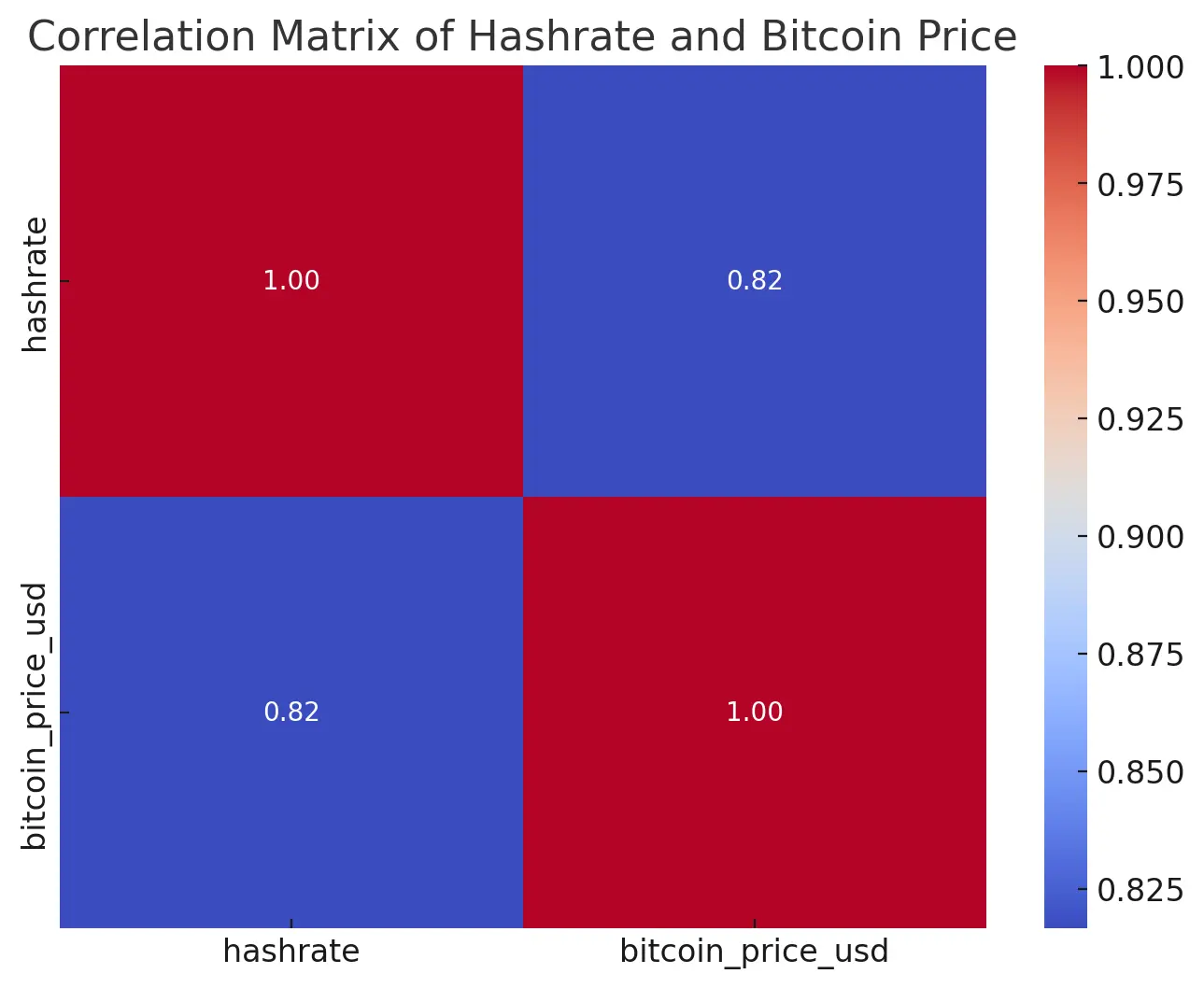

Correlation Analysis: The Hashrate-Price Connection

In this study, a strong positive correlation of approximately 0.82 was uncovered between the hashrate and the Bitcoin price. This compelling correlation, observed over the course of several months in 2023, suggests a synchronous movement between these two pivotal aspects of the Bitcoin ecosystem.

Interpreting the Data: Beyond Surface-Level Trends

This significant correlation could indicate that as mining activities intensify and the network strengthens (reflected in a rising hashrate), the price of Bitcoin also tends to increase. This relationship might be due to enhanced mining profitability driving more miners to join the network, or it could reflect heightened investor confidence in a robust and secure blockchain.

Caveats and Considerations: Correlation Does Not Mean Causation

It’s crucial to note that while the correlation is strong, it does not inherently imply causation. The intricate dynamics of Bitcoin’s ecosystem are influenced by a myriad of interconnected factors, making it challenging to pinpoint direct causative relationships.

Conclusion: Charting the Course of Bitcoin’s Journey

This analysis of the correlation between Bitcoin’s hashrate and price sheds light on the intricate interplay within the blockchain ecosystem. As Bitcoin continues to carve its niche in the global financial landscape, understanding such correlations becomes vital for investors, analysts, and enthusiasts navigating this digital currency’s future.